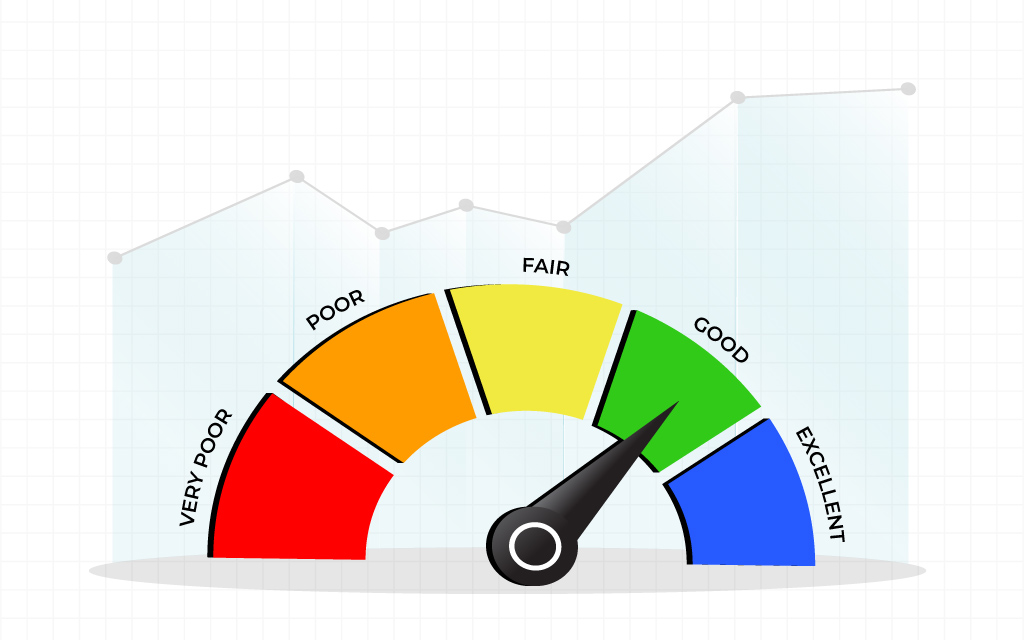

Good credit history is the condition for achieving a higher credit score. Now, how to maintain a good credit history?

Credit history is determined by certain pieces of information such as the number of credit cards you use or the number of loan accounts you hold, the frequency of the repayment of your credits, the balance you hold in your credit account, and so forth.

Though it seems facile it demands a little bit of financial understanding. It is irrelevant if you are a beginner or already on the run, what matters is how well you manage your credit score and that you seek improvement.

So here are some ways you can improve your credit score with some insignificant maintenance:

- Keeping an eye on your credit reports

Regulating your credit report in a timely manner helps you detect the loopholes in the report that probably is bringing your credit score down. This will help you understand the sequence of events that are hurting your credit scores such as payments and defaults. Sometimes it may be the case that you have done your part sincerely, but it isn’t reflected in your credit score. In that case, you should update the same to your credit rating agency.

- Curtail sending regular applications for loan account

It may be that your credit application was rejected by the lender, or you want to open a new account to construct your credit file. Whatever might be the reason make sure the frequency of it is limited. A frequent credit application creates a hard pull i.e., the creditor looks at your credit file to calculate the risk you possess as a borrower. This doesn’t make a considerable effect on your credit score, but a lot of them hurts in the long run.

- Timely repayment of your credit dues

Checking your due dates and making a timely payment should be the first step toward maintaining your credit score. Staying disciplined while paying your credit dues keeps your credit history stable and helps you hold a good reputation in the books of the lenders or the creditors.

- Avoid high credit utilization

Always take into consideration the credit utilization ratio, as it directly impacts your credit score negatively. Try and keep your credit utilization value within 30% as any number over that shows that you are not financially stable. Having a high credit utilization ratio portrays to the lenders that you are credit thirsty and that eventually lowers your credit score.

- Never borrowed funds in the past. Here’s what you can do

If you have never borrowed any funds in the past, you will not have any credit history. Not having any credit history potentially would lower your credit score so, to maintain your score you should prefer taking mixed loans.

Mixed loans or mixed credit includes secured as well as unsecured loans for a long and a short time to strengthen your credit score.

- Debt consolidation

A debt consolidation loan is something that you can opt for when you have multiple debts on your plate. You can ask your credit union or bank to consolidate all your debts and hence you make just one payment for all of them. This can act as an advantage for your credit score.

- Try and maintain old credit cards

Opting for new credit cards or loan accounts every time you borrow a debt can harm your available credit balances on your existing credit card. This may harm your credit history thereby ruining your credit score.

- Long repayment tenor = Good credit score

Whether you opt for credit or loan per se, try to take a longer repayment tenor. This will help you with lower interest rates and would leave a good impact on your credit history. And by now we have understood that a good credit history directly impacts your credit score positively.